The 45-Second Trick For Independent Investment Advisor copyright

The 45-Second Trick For Independent Investment Advisor copyright

Blog Article

Facts About Ia Wealth Management Revealed

Table of ContentsThe Facts About Tax Planning copyright RevealedFascination About Investment ConsultantHow Lighthouse Wealth Management can Save You Time, Stress, and Money.Fascination About Investment RepresentativeFascination About Ia Wealth ManagementThe Definitive Guide to Private Wealth Management copyright

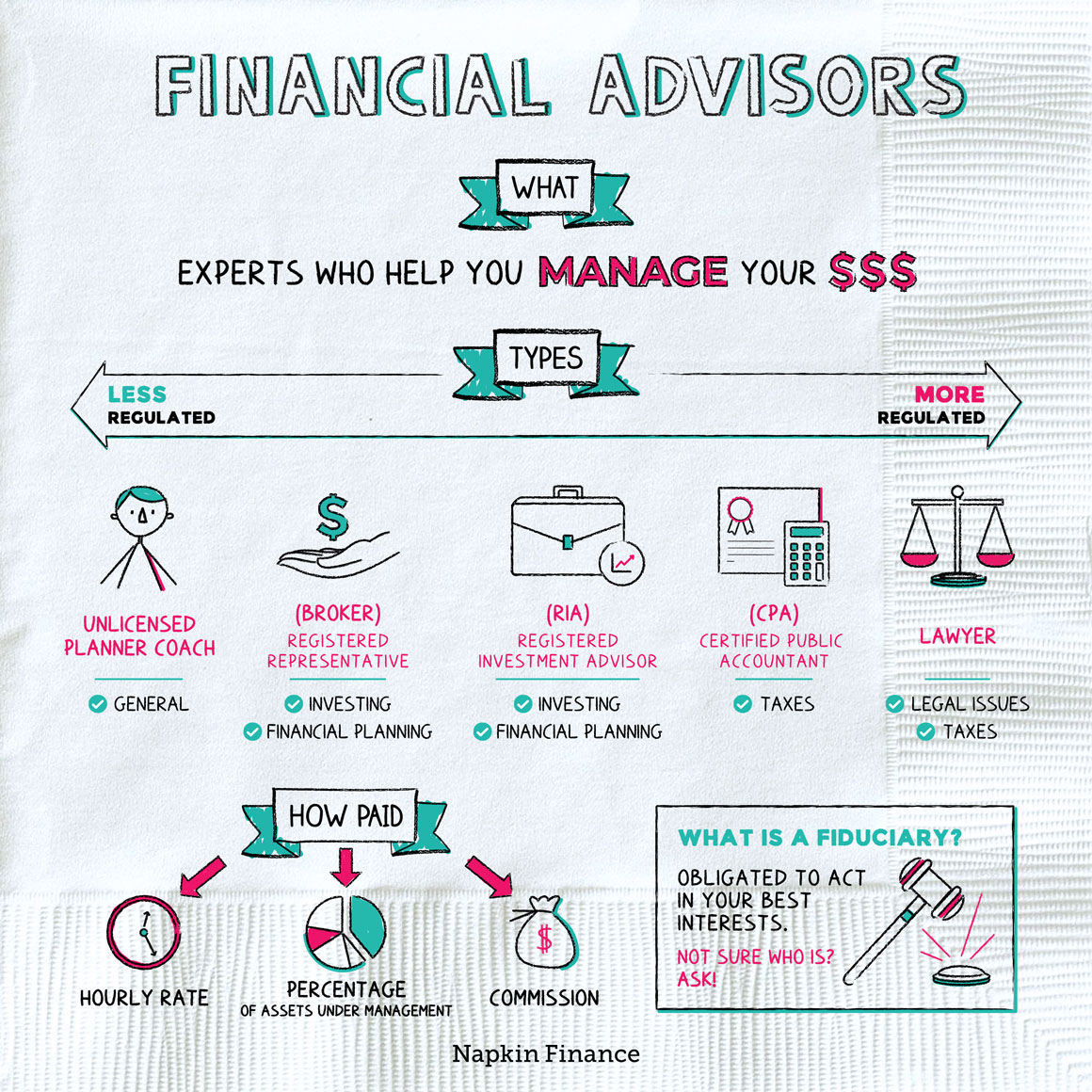

Heath can also be an advice-only planner, this means he doesn’t control his consumers’ money immediately, nor really does he offer them particular financial loans. Heath states the benefit of this approach to him is the fact that he does not feel certain to provide a certain product to fix a client’s money dilemmas. If an advisor is just prepared to market an insurance-based means to fix problematic, they might finish steering someone down an unproductive path into the name of striking income quotas, according to him.“Most monetary solutions people in copyright, because they’re compensated based on the items they provide and sell, they can have reasons to suggest one course of action over the other,” according to him.“I’ve plumped for this program of motion because I can check my customers in their eyes and not feel just like I’m using them in any way or attempting to make a sales pitch.” Story goes on below advertising FCAC notes how you shell out the advisor depends upon this service membership they provide.

Rumored Buzz on Tax Planning copyright

Heath and his awesome ilk are paid on a fee-only product, this means they’re compensated like a legal professional might be on a session-by-session foundation or a per hour assessment rate (private wealth management copyright). With regards to the selection of solutions while the expertise or common clients of expert or planner, hourly fees can range inside the hundreds or thousands, Heath states

This could be as high as $250,000 and above, he says, which boxes

Some Known Incorrect Statements About Tax Planning copyright

Tale goes on below ad discovering the right economic planner is a little like matchmaking, Heath claims: You want to discover some body who’s reputable, has actually a character fit and it is ideal person for your period of life you are really in (https://www.cgmimm.com/professional-services/lighthouse-wealth-management-a-division-of-ia-private-wealth). Some choose their unique analysts to-be earlier with much more experience, he states, while some prefer someone younger who are able to hopefully stick with all of them from early many years through retirement

About Financial Advisor Victoria Bc

One of the largest blunders somebody could make in choosing an expert is not inquiring sufficient concerns, Heath says. He’s shocked as he hears from consumers that they’re stressed about inquiring questions and possibly showing up foolish a trend he discovers is just as normal with developed specialists and the elderly.“I’m amazed, given that it’s their money and they’re paying countless costs to these individuals,” according to him.“You need to have the questions you have answered while are entitled to for an open and truthful commitment.” 6:11 economic Planning for all Heath’s last guidance is applicable whether you’re seeking outside monetary assistance or you’re heading it alone: become knowledgeable.

Here are four points to consider and inquire your self when finding out whether you need to engage the knowledge of a financial specialist. The net really worth just isn't your earnings, but alternatively a quantity which can help you realize exactly what money you get, exactly how much you save, and the place you spend cash, as well.

Fascination About Tax Planning copyright

Your infant is found on just how. The divorce proceedings is actually pending. You’re approaching your retirement. These along with other significant existence events may prompt the need to visit with a financial expert regarding the investments, debt goals, and various other financial issues. Let’s state your own mom left you a tidy sum of money inside her might.

You've probably sketched your own monetary program, but have a tough time keeping it. A monetary consultant can offer the responsibility you need to place your monetary anticipate track. Additionally they may advise how-to tweak the monetary plan Extra resources - http://go.bubbl.us/dec75e/3e85?/New-Mind-Map being maximize the potential outcomes

Private Wealth Management copyright Fundamentals Explained

Anybody can say they’re an economic specialist, but a specialist with professional designations is actually preferably one you need to employ. In 2021, an estimated 330,300 Us americans worked as private economic analysts, according to the U.S. Bureau of Labor studies (BLS). Most monetary advisors tend to be freelance, the agency claims - investment consultant. Typically, you'll find five kinds of financial advisors

Agents generally obtain profits on deals they generate. Agents are controlled by the U.S. Securities and Exchange Commission (SEC), the economic Industry Regulatory Authority (FINRA) and state securities regulators. A registered investment specialist, either you or a strong, is similar to a registered representative. Both buy and sell assets on the part of their customers.

Report this page